The book has been published according to the revised syllabi of B.Com (Pass) Vth & VIth Semester of Maharshi Dayanand University, Indira Gandhi University, Gurugram University, Chaudhary Bansi Lal University.

In this revised edition, several new Illustrations (solved) of real worth have been added and questions graded. All the chapters have been closely screened and revised to make the book utility-oriented in a larger measure. Questions asked in various universities examinations have been incorporated in the book.

Besides, in this edition following chapters have been thoroughly revised and enlarged :

- Unit or Output Costing-I (Cost Sheet, Cost Statement and Production Account)

- Contract Costing (Including AS-7)

- Reconciliation of Cost and Financial Accounts

The chapter on ‘Cost Audit’ has been thoroughly revised on the basis of Companies Act, 2013 and Companies (Cost Records and Rules), 2014.

The Illustrations and Practical Questions have been given Topic-wise, graded from easy to difficult. The students of elementary studies may select easy questions Topic-wise and leave difficult ones.

The most important feature of this edition is that some advanced exercises with solutions and problems with answer have been given chapter-wise at the end of the book.

A companion book `Practical Problems in Cost Accounting’ prepared by the same authors has been published for the benefits of the students. The book contains solutions to the unsolved problems given at the end of each chapter of this book under the heading `Numerical Questions’.

Cost Accounting New Syllabus For B.Com (Pass) Vth Semester of Maharshi Dayanand University, Indira Gandhi University, Gurugram University, Chaudhary Bansi Lal University

Unit–I: Cost Accounting: Meaning, Features, Scope, Techniques, Methods, Objectives, Importance and Limitations. Costing; Cost Accountancy; Cost Centres and Profit Centres, Difference and similarities of Cost Accounting System with Financial Accounting System. Cost: Main elements and types. Material Control: Meaning and objectives of material control, Material purchase procedure, Fixation of inventory levels–reorder level, Minimum level, Maximum level, Danger level, EOQ analysis. Methods of Valuing Material Issues. Wastage of material-Main types.

Unit–II: Labour Cost Control: Importance, methods of Time Keeping and Time Booking; Treatment and Control of Labour Turnover, Idle Time, Overtime, Systems of Wage Payment Time Wage System, Piece Wage System. Incentive Wage plans—Individual plans and Group plans.

Unit–III: Overheads: Meaning and Types. Collection, Classification; Allocation, Apportionment and Absorption of Overheads-Main methods.

Unit–IV: Unit and Output Costing: Meaning and objectives; Cost Sheet – Meaning, Performa, types preparation of cost sheet; Determination of tender price; Production Account – types.Reconciliation of Cost and Financial Accounts: Meaning. Objectives and procedure.

Cost Accounting New Syllabus For B.Com (Pass) VIth Semester of Maharshi Dayanand University, Indira Gandhi University, Gurugram University, Chaudhary Bansi Lal University

Unit–I: Process Costing: Meaning; Uses; Preparation of Process Account, Treatment of Normal Wastage, Abnormal Wastage, Abnormal Effectiveness; Treatment of opening and closing stock (Excluding Work in Progress): Joint – Product and By-Product: Main methods of apportionment of Joint cost. Interprocess profits.

Unit–II: Contract Costing: Meaning, main features, Preparation of Contract Account, Escalation clause; Contract near completion; Cost-plus contract. Job and batch costing.

Unit–III: Budgetary Control: Meaning of budget and budgetary control, Budgetary control as a management tool, Limitations of budgetary control, Forecasts and budgets, Installation of a budgetary control system, Classification of budgets, Fixed and flexible budgeting, Performance budgeting, Zero-based budgeting and Responsibility accounting.Standard Costing: Meaning, limitations, Standard costs and budgeted costs, Determination of standard cost, Cost variances, Direct material and direct labour only.

Unit–IV: Marginal Costing and Profit Planning: Marginal costing, Absorption costing, Marginal cost, Cost Volume Profit analysis, BEP Analysis, Key factor, BE chart, Angle of incidence, Concept of decision-making and steps involved, Determination of sales mix, Make or buy decisions.

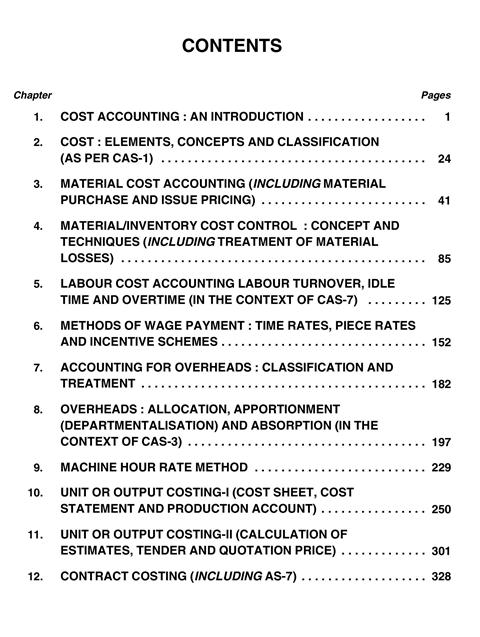

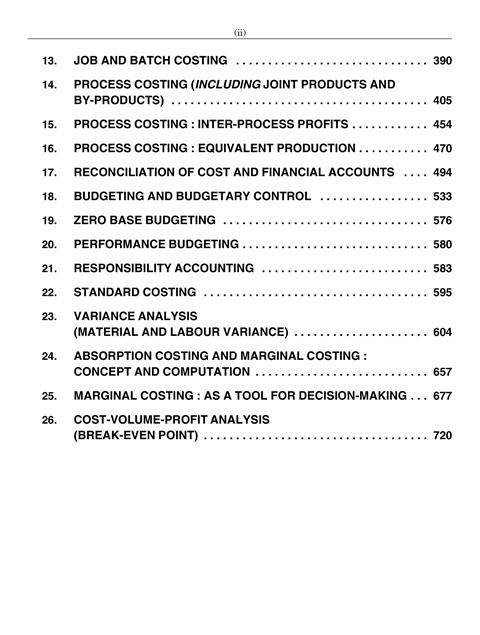

Cost Accounting Book Contents

- Cost accounting: an Introduction

- Cost: Elements, Concepts and Classification (As Per CAS-1)

- Material Cost accounting (including Material Purchase and Issue Pricing)

- Material/Inventory Cost Control: Concept and Techniques (including Treatment of Material Losses)

- Labour Cost accounting Labour Turnover, Idle Time and Overtime (in the Context of CAS-7)

- Methods of Wage Payment (including Incentive Schemes)

- Accounting For Overheads: Classification and Treatment

- Overheads: allocation, apportionment (Departmentalisation) and absorption (in the Context of CAS-3)

- Machine Hour Rate Method

- Unit Or Output Costing-I (Cost Sheet, Cost Statement and Production account)

- Unit Or Output Costing-II (Calculation of Estimates, Tender and Quotation Price)

- Reconciliation of Cost and Financial accounts

- Process Costing (including Joint Products and By-Products)

- Process Costing: Inter-Process Profits

- Process Costing: Equivalent Production

- Contract Costing (including AS-7)

- Job and Batch Costing

- Budgeting and Budgetary Control

- Zero Base Budgeting

- Performance Budgeting

- Responsibility accounting

- Standard Costing

- Variance analysis (I) (Material & Labour Variance)

- Absorption Costing and Marginal Costing: Concept and Computation

- Marginal Costing: as a tool for Decision-Making

- Cost-Volume-Profit analysis: Break-Even Point

● Revisionary Exercises and Problems

Reviews

There are no reviews yet.